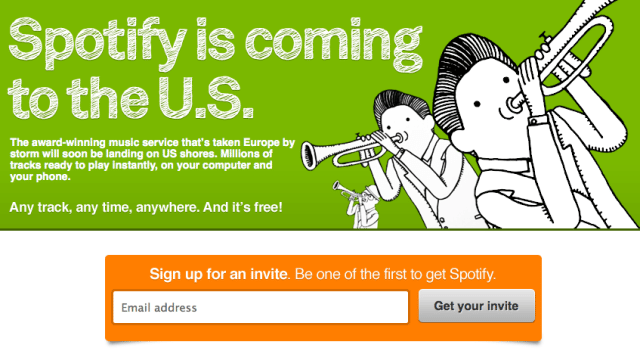

It’s been a day of progress for music streaming service Spotify. In the morning: a deal with Virgin Media in the UK for a TV/online/mobile streaming service, its first such offer in the UK. And in the afternoon: its much-anticipated official launch in the U.S. But after making the music-listening U.S. masses wait for two years for open for business, they’re not letting them in that easily. Spotify has a sign-up page, but it still hasn’t given a date for when the service will go live, or how much it will cost.

Spotify tells us that it is not going to be more specific right now. “We’re working hard to launch the service in the US as soon as possible. All we can say right now is watch this space,” said a spokesperson.

No word from Spotify yet on how many people have used the form to register their interest, but in the last several minutes while writing this post, I have noticed — for what it’s worth — that the “like” button at the bottom of the page has grown by 1,000 to “5k”.

Some of the attention the site is getting will come from pent-up demand for the service. But equallly important is that as digital music, and streaming, have grown in popularity, there have been a handful of streaming music companies doing relatively well — for example Rhapsody’s 750,000 paying customers — and versions of cloud music services from announced or launched Apple (NSDQ: AAPL), Google (NSDQ: GOOG) and Amazon (NSDQ: AMZN), but no one cornering the market for streaming — leaving the opportunity largely untapped for unlimited players like Spotify.

In addition to Rhapsody, Mog and Rdio are the other two main big-name competitors, and there are also a host of smaller names snapping at their heels and Pandora (NYSE: P) occupying the non-interactive streaming space.

Another key factor means Spotify may not replicate its European growth pace in America – its customer acquisition strategy has changed. Spotify boomed after its launch in October 2008 not just because its app was slick but also because it offered unlimited free desktop music with ads. European label divisions, which hold equity in Spotify, are fairly happy with the results – a reduction in piracy and a million new paying customers…

But, met with skepticism from U.S. divisions, Spotify has, on both sides of the pond, halved free streaming time to just 10 hours per month and only five repeat track plays.

Spotify was clearly reluctant; telling paidContent in April: “What is driving users to paid is the free service. The ‘free’ experience, in fact, pays big dividends. That’s why it is so vital we continue to make the free service available.” But its consent to labels means freemium is likely to play a smaller role in future.

That has been the cost of a U.S. launch. Whilst it was a condition that has diminished the free European proposition, Spotify appears to have decided it has sufficient scale there to warrant its evolution from a startup in to a proper, money-making business.

On a growing sector like music subscription and in the world’s biggest market, Spotify will see nothing but growth on the consumer front. But Spotify is having to take investment to go global – only time will tell when it will work that off…