Some critics may observe “paywalls” don’t work — but try telling that to investors.

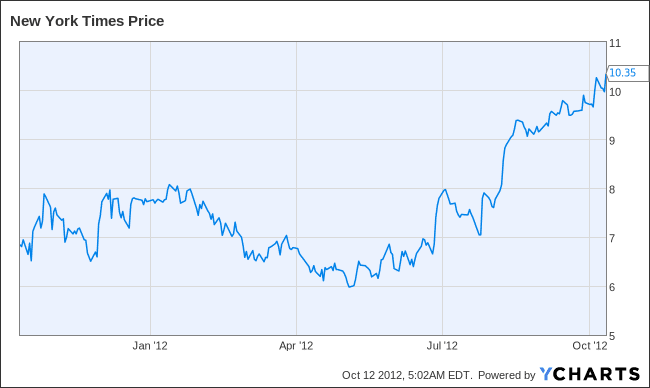

New York Times (s NYT) shares closed at a 52-week high on Thursday after Barclays analyst Kannan Venkateshwar upgraded the stock to the equivalent of a “buy,” writing (via AP and Bloomberg):

“The increase in circulation revenues from the company’s digital paywall is now meaningful enough to offset the decline in print advertising.

“It is also adding to its Sunday home delivery subscriber base now after many years of decline.”

The New York Times and International Herald Tribune added 12 percent more paying digital subscribers between March 18 and June 24, the publisher reported this August. Fifteen months after beginning to charge for reading more than ten articles and on reading devices, it hit 509,000 digital subscribers.

Together with hikes in home delivery and weekday cover prices, that helped cross-format circulation revenue up 8.3 percent, offsetting print decline, it said.

Together with hikes in home delivery and weekday cover prices, that helped cross-format circulation revenue up 8.3 percent, offsetting print decline, it said.

Such metrics show how publishers can steady their ships after years of decline. But much of the growth is likely thanks not just to appetite for content in situ but to new tablet and smartphone devices, which are creating a new appetite for the same content in new formats and which make payment easier.

After selling off About.com $290 million, Indeed.com for $100 million and others for a total $650 million, Barclays’ Venkateshwar also suggested NYT has $935 million in cash, meaning an “increased likelihood of cash return to equity holders. No wonder investors are looking for a piece of NYT pie.

All of this is fine in a commercial sense — but what about in audience terms, where a journalism business’ influence is really defined? NYTimes.com web traffic has been broadly unchanged despite the fees introduction, figures earlier this year showed.

In hindsight it seems pretty clear that the people who said pay walls would never work were the backward looking traditionalists

— Benedict Evans (@BenedictEvans) October 12, 2012

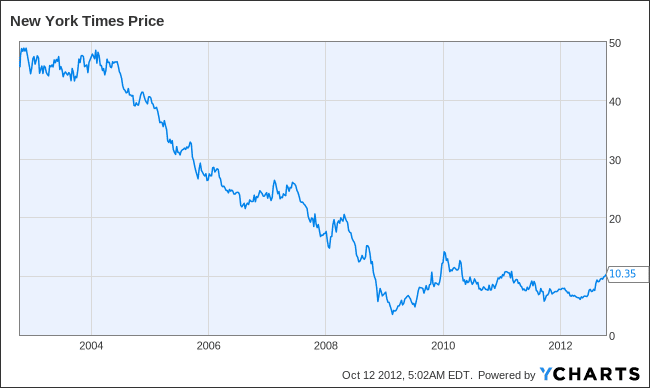

It is also worth pulling back to note that, whilst NYT stock has currently returned to late-2009 levels, in relative terms it is close to the bottom of the cliff it and other newspapers jumped off in the middle of the decade.