Get set for some disruption in the pay TV market in 2013. The proportion of customers who change service is set to double over the next year, research says.

The Oliver & Ohlbaum media strategy agency shows how 10.3 percent of surveyed pay TV subscribers in the UK plan to change their service over the next year…

That is twice as many people who said they would change in 2013 — and also more than the proportion of people who actually did so.

Where will they go? Whilst it might be tempting to look for evidence of widespread “cord cutting”, that is not what we see here…

Instead, most of those who plan to change say they will simply remove paid channels from their existing package. Channel additions by consumers look set to shrink markedly next year. And the numbers who plan to switch down to Freeview terrestrial TV are rising.

In all, this likely points to a consumer response to worsening economic times, with disposable income relative to many consumer goods shrinking, rather than the effect of new internet TV services.

The proportion of consumers who plan to switch from pay TV to on-demand services is up from last year, but only by one percent.

A minority, 16 percent, of those surveyed said they were likely to buy a box for YouView — the UK hybrid terrestrial and internet TV joint venture — in the next year.

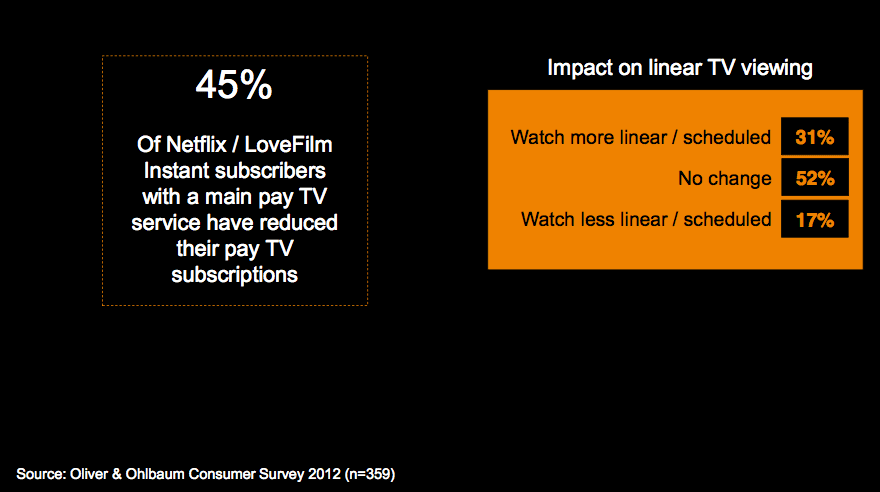

But don’t rule out internet TV growth. Amongst those who do subscribe to internet video services, behaviour change is profound. Forty-five percent of Netflix UK and Lovefilm Instant subscribers say they have reduced their pay-TV subscriptions, though many of them are actually watching more linear TV…

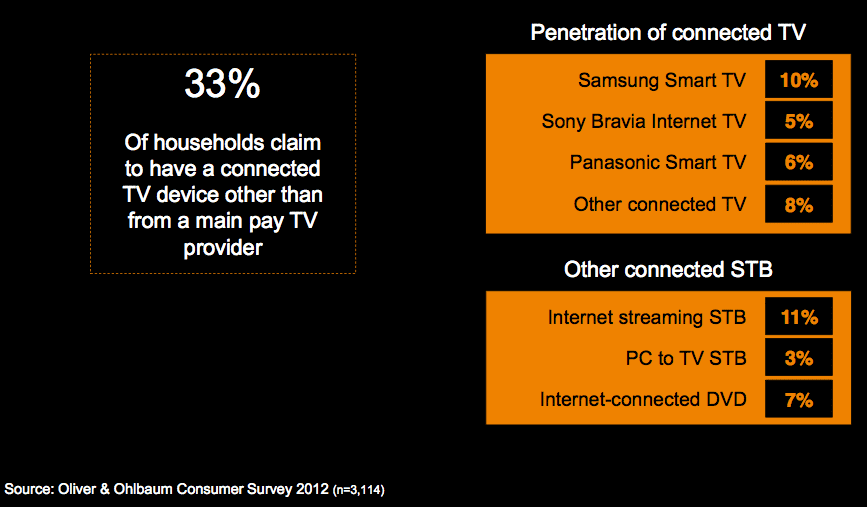

Oliver & Ohlbaum’s survey found 33 percent of households already have a connected TV device other than that from a pay TV provider. Samsung’s models top the list of connected TV models that most frequently are actually connected.