While Apple TV(s AAPL) already exists as a set-top box “hobby,” prospects for it turning into a TV set that might reinvent the broadcast business are lengthening to a November 2013 launch, according to one of the most-watched Apple watchers.

What are the chances for such a product, if it might arrive? Different, depending where you are in the world, perhaps. Sanford C. Bernstein senior U.S. media analyst Todd Juenger told an investor briefing (summary):

“I think Apple is largely stymied in the US to do anything truly disruptive in terms of the television ecosystem. All of the content that people care about most is in the hands of the US media companies … None of them has really any discernible upside to gain from entering into any agreement to make that content available to Apple … In fact, they have a lot to lose by doing that … Apple would need to do that to really disrupt things. What Apple has left to do is to build a device.”

Juenger says the absent middle ground in the U.S. TV ecosystem — between the expensive multi-channel pay TV most viewers buy and the five-network free TV a minority take — is not about to be occupied any time soon by a cheaper or alternative service offered by the likes of Apple.

However, in Europe, Bernstein says, the situation may be more promising for Apple. Senior European media analyst Claudio Aspesi told investors (summary):

“Several players (including new entrants and Telcos) are trying to potentially find a niche and a play; if this process were to lead to a sufficiently fragmented market, it would be easier (relative to the US) for technology companies to find a foothold in content. If the market fragments that much, then, it will be all that much easier for Apple (or Google or Amazon), at some point, to come in and consolidate this.”

I agree that each market is different but, in some ways, I have the opposite conclusion. Although Apple, under Steve Jobs, broke ground by licensing rights to sell and rent out movies and TV episodes in its native market, elsewhere around the world it has been relatively lackluster at acquiring content rights in the same way.

On that track record, I would not be confident that Apple can sign to acquire TV content in Europe with the same success rate it could at home, certainly not at the same time as U.S. TV content — not least because the pronounced differences in the two businesses would compel Apple to negotiate using different strategies at the same time.

Regardless, whether Apple really wants to sign content in the way many describe it is far from certain. Most technology companies describe themselves as platforms, not content owners, and the thing they can best bring to bear on content industries is user interface accessibility improvements.

Regardless, whether Apple really wants to sign content in the way many describe it is far from certain. Most technology companies describe themselves as platforms, not content owners, and the thing they can best bring to bear on content industries is user interface accessibility improvements.

We have recently seen no outcome affirmative conclusion to the slightly far-fetched notion — mooted in some media quarters — that Apple or Google(s GOOG) would bid for expensive European soccer rights. Indeed, whilst a growing number of YouTube channels is launching to host some highlights, YouTube is taking pains to distance itself from ownership of those videos.

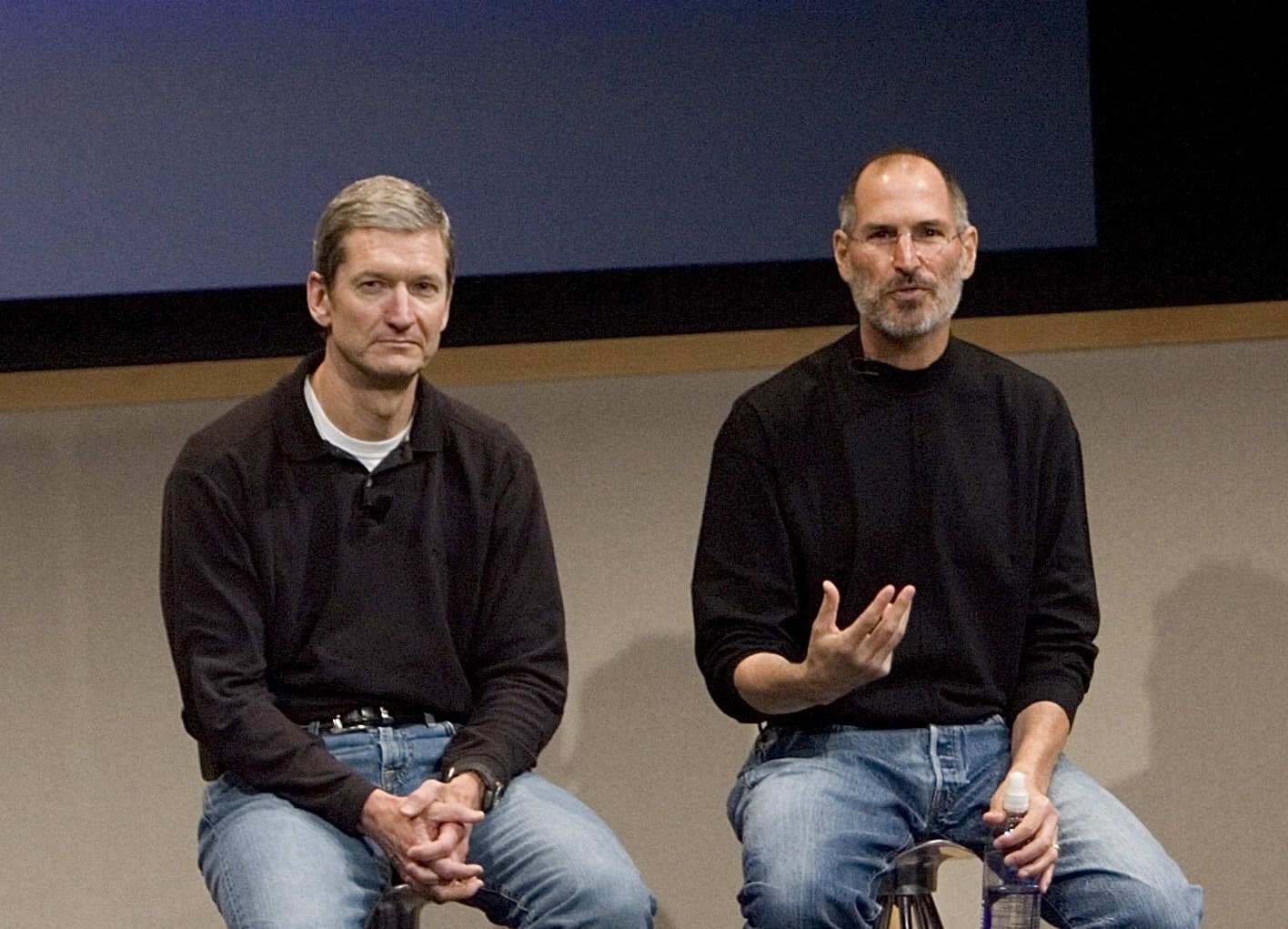

Apple’s interest, however, remains clear, and may even have graduated beyond the “hobby” status that Jobs once gave the company’s TV interests, judging by CEO Tim Cook’s comments to NBC’s Brian Williams in an interview this weekend:

“When I go into my living room and turn on the TV, I feel like I have gone backwards in time by 20 to 30 years. It’s an area of intense interest. I can’t say more than that.”

Read our recent story on why digital media banker Terence Kawaja thinks tech firms hoping to disrupt the TV business “cabal” are going to be hard-pressed.

Apple has shown that it can disrupt and support one content industry in the past — music. iTunes Store popularized the track download format, restored legal consumption to a business diminishing in Napster’s heyday, and atomized the album.

Much of that was imagined by Jobs. What can Cook bring to TV execs’ tables?